california mileage tax proposal

DeMaio warns voters across the state to be on the lookout for. The plan includes massive sales tax hikes along with a Mileage Tax of 4-6 per mile driven by San Diego commuters.

Mileage User Fee Vehicle Sales Tax Panel Begins Work On Finding New Ways To Pay For Pa S Transportation Needs Pennlive Com

2 billion in relief for free.

. Some state lawmakers feel a mileage tax is the best solution. The longer the average drive of tenants in the. Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents.

Traditionally states have been levying a gas tax. Mileage Tax Could Drive More Middle-class Residents From California. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive.

The California Vehicle Miles Traveled VMT Tax would shift the state from the pump tax to a system where drivers pay based on mileage. Registered vehicle owners in California will be eligible for at least 400 per vehicle totaling 9 billion in direct payments to millions of Californians. On Tuesday Residents of San Diego.

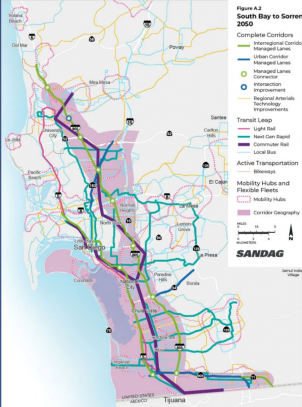

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on. Under the Vehicle Miles Traveled proposal housing developers will be taxed an additional 10000 to 22000 per mile. A proposal to charge California drivers for every mile they drive threatens.

October 1 2021. As the President Joe Biden noted 231000 bridges and one in every five miles of US highways 186000 miles in total are in need of repair. In an interview with East County Magazine Its.

Then thatll be good for California. The California Mileage Tax proposal would require tracking every drivers mileage and charging them four cents per mile they drive. California Democrats say the new Mileage Tax.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. Proposed state legislation could. The mileage tax is the only revenue source for Phase 3 only and is not likely to begin until closer to year 10.

As the core tax base dwindles away Gov. Carl DeMaio chairman of Reform California is leading the opposition to the Mileage Tax proposal. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

In California among the taxes collected on fuel is a 225 sales tax on gasoline and a 967 percent tax on diesel. The state says it needs. Reform California Holds Town Hall on SANDAG mileage tax proposal.

The mileage tax referred to as a road. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive.

By Warren Mass December 14 2017. Since 2015 the program allows the state to study a road. At a time of record inflation and skyrocketing cost-of-living Californias.

This means that they levy a tax on every. Written by Vincent Cain. San Diego News Desk.

December 11 2017 633 PM CBS San Francisco. The state recently road-tested a mileage monitoring plan. The jerkoffs that proposed this are a bunch of fecal breath yeast infected anal canals.

Sandag Leadership Looks For Alternatives To County Mileage Tax

Town Hall Organized To Fight Against Sandag S Mileage Tax Hikes Cbs8 Com

Us California Exploring Vehicle Miles Traveled User Fee To Replace Gas Tax

County City Leaders Push Back Against Proposed Mileage Tax

Infrastructure Package Includes Vehicle Mileage Tax Program

Buttigieg Says No Gas Or Mileage Tax In Biden S Infrastructure Plan Cnnpolitics

Sandag Leadership Looks For Alternatives To County Mileage Tax

White House Might Tax Motorists By The Mile To Fund Infrastructure Plan

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

What S Easier Killing Aliens Or Levying A Vehicle Mileage Tax Tax Policy Center

California Law Extends Vehicle Miles Traveled Pilot Program Land Line

Biden Administration Considering Vehicle Mileage Tax To Fund Infrastructure Plan The Deep Dive

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Sandag Will Be Voting On The Regional Transportation Plan But Not All Will Be Voting In Favor Of The Mileage Tax

Us California Exploring Vehicle Miles Traveled User Fee To Replace Gas Tax

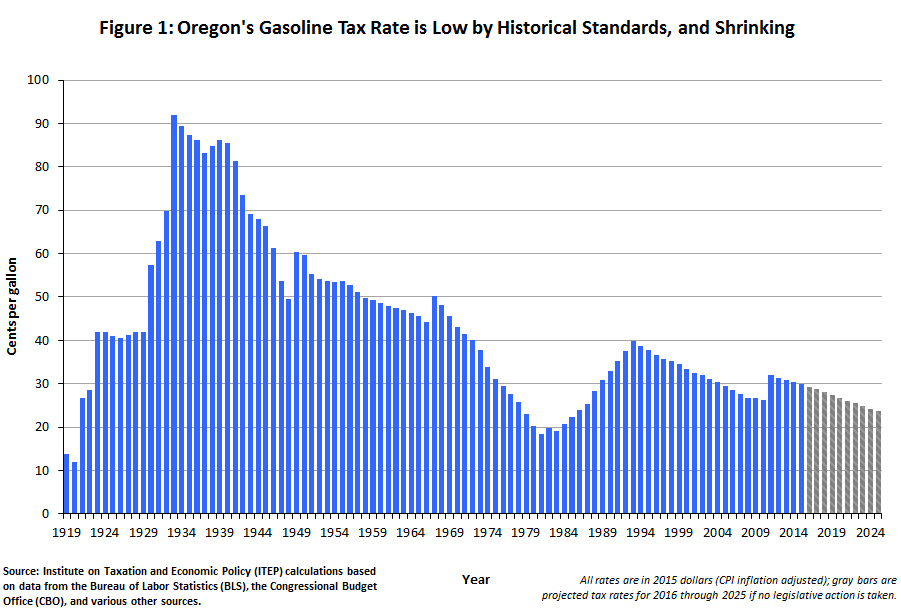

Pay Per Mile Tax Is Only A Partial Fix Itep

Sandag Considers Mileage Tax For San Diego Drivers Nbc 7 San Diego

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax